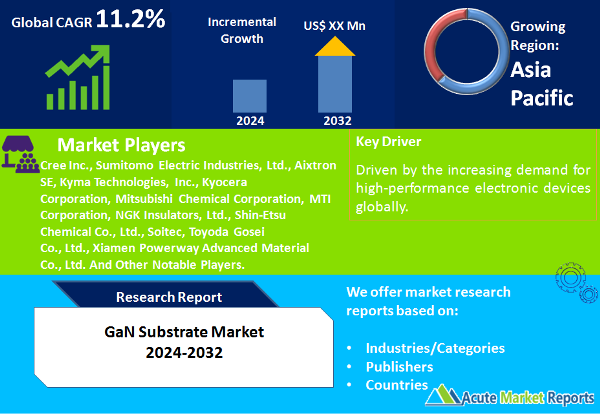

GaN Substrate Market Size, Share, Trends, Growth And Forecast To 2032

Increasing global demand for high-performance electronic devices is anticipated to propel the GaN substrate market to a CAGR of 11.2% during the forecast period of 2024 and 2032. The Asia-Pacific region remains the global leader in terms of revenues, primarily due to significant investments in research and development, which facilitate technological progress and the extensive utilization of GaN substrates. The substantial revenue contributions from North America and Europe can be attributed to their robust presence in the semiconductor and electronics sectors, respectively. The prevalence of dominant firms such as Cree Inc., Sumitomo Electric Industries, Ltd., and Aixtron SE is underscored by competitive trends, which also emphasize the significance of mergers and acquisitions, strategic partnerships, and product innovation. The market as a whole is anticipated to exhibit a dynamic nature, influenced by technological progress, cooperative endeavors, and the struggle for supremacy by major participants.

Key Market Drivers

The GaN substrate market is being significantly propelled by the exponential growth of power electronics applications. The utilization of GaN substrates is critical in the advancement of power devices that require exceptional performance attributes, including elevated electron mobility and thermal stability. The adoption of GaN substrates is being fueled by the rising demand for energy-efficient electronic systems, particularly in applications such as electric vehicles, renewable energy systems, and power supplies. The increasing prevalence of GaN-based power devices across diverse sectors provides empirical support for the material’s capacity to improve energy efficiency and facilitate the development of sustainable technological solutions.

The market is additionally propelled by the expanding demand for RF devices operating at high frequencies. GaN substrates are essential for use in the aerospace, defense, and telecommunications industries due to their exceptional RF properties. The growing utilization of GaN-based radio frequency (RF) devices in communication infrastructure, radar systems, and satellite communication provides clear evidence in support of this driver. GaN substrates’ stability and capability to operate at higher frequencies distinguish them as the material of choice for next-generation radio frequency (RF) technologies, thereby stimulating the expansion of the market.

GaN substrates are widely utilized in optoelectronic applications, which strongly contributes to the expansion of the market. The advancement of laser diodes and high-brightness light-emitting diodes (LEDs) is dependent on the exceptional characteristics exhibited by GaN substrates. The pervasive adoption of GaN-based optoelectronic devices in numerous industries—including medical imaging, automotive lighting, and displays—provides evidence in support of this driver. GaN substrates are a foundational material for electroelectronics advancements due to their distinctive combination of broad bandgap and optical transparency.

Browse for report at : https://www.acutemarketreports.com/report/gan-substrate-market

Restraint: Limitations in the Supply Chain and Production Expenses

The GaN substrate market is characterized by significant expansion; however, it is significantly impeded by limitations in the supply chain and high production expenses. The manufacturing process for producing GaN substrates of superior quality is intricate, resulting in increased production expenses. The constraints mentioned above are substantiated by the difficulties encountered by manufacturers in ensuring a reliable and economical supply chain for GaN substrates. Particularly in price-sensitive sectors, these limitations may affect market expansion and require strategic approaches to resolve production efficiency and cost concerns.

Key Market Segmentation Analysis

Market by Type

The GaN substrate market comprises a wide variety of categories, with each type making a substantial contribution to both revenue and compound annual growth rate (CAGR). GaN on Sapphire emerges as the type with the highest revenue generation in 2023, propelled by its extensive implementation in applications that demand exceptional crystal quality and thermal stability. Concurrently, from 2024 to 2032, GaN on Diamond exhibits the highest CAGR due to the material’s extraordinary thermal conductivity and durability, which render it well-suited for challenging environments. GaN deposited on Si and GaN deposited on GaN are also pivotal, demonstrating consistent revenue and CAGR growth. The market is segmented by type, which signifies the adaptability of GaN substrates in meeting the specific needs of various industries.

Market by Size

The market dynamics of GaN substrates are significantly influenced by the size segmentation. 6-inch substrates will generate the most revenue in 2023 due to their optimal balance of wafer real estate utilization and manufacturing cost. On the contrary, the CAGR for 4-inch substrates is the highest throughout the projected period, indicating an increasing inclination towards wafers of lower dimensions. This phenomenon is impacted by considerations including cost efficiency and the capacity to cater to the particular requirements of specific applications. The variety of dimension options, which encompass 2 Inch and 8 Inch, enhances the adaptability of the market in meeting the diverse demands of different industries.

Market by Application

The market segmentation of GaN substrates according to their applications highlights their adaptability in the production of a wide range of electronic components. Transistors become the most lucrative application in 2023, attesting to the indispensable function of GaN substrates within the realm of power electronics. Concurrently, from 2024 to 2032, LEDs exhibit the maximum CAGR, propelled by the escalating need for energy-efficient and high-performance lighting solutions. In addition to ICs and controllers, RF devices, lasers, and other applications, including ICs, make substantial contributions to both revenue and CAGR. The broad range of applications that GaN substrates find themselves in underscores their pervasive utilization in the progression of numerous electronic technologies.

Market by End Users

The end-use industry segmentation of the GaN substrates market offers valuable insights into the extent of market penetration in different sectors. The IT & Telecommunication industry will dominate in terms of market share and revenue in 2023, underscoring the critical importance of GaN substrates in applications involving high frequencies. On the contrary, the automotive industry demonstrates the most substantial compound annual growth rate (CAGR) over the projected timeframe. This is primarily attributed to the expanding utilization of GaN-based components in electric vehicles and sophisticated driver-assistance systems. The market’s strong performance is further supported by various industries, including consumer electronics, aerospace, and defense, healthcare, and others. This demonstrates the extensive utilization of GaN substrates in a broad range of sectors. The end-use industry segmentation of the market is indicative of the material’s capacity to accommodate the changing requirements of contemporary electronic applications.

APAC Remains the Global Leader

Geographic trends in the GaN substrate market are dynamic, with Asia-Pacific emerging as the region with the greatest percentage of revenue and CAGR. Asia-Pacific generated the most revenue in 2023, primarily due to the robust semiconductor industry that is concentrated in countries such as China, Japan, and South Korea. The region’s escalating investments in research and development are responsible for the highest CAGR; these investments promote technological progress and facilitate the widespread implementation of GaN substrates in various sectors. Revenue percentage is followed closely by North America, which is propelled by the presence of significant semiconductor manufacturers and an emphasis on innovation. Europe’s substantial revenue contribution to the market is bolstered by the expanding automotive and electronics industries. Although the Middle East and Africa hold a relatively lesser portion of the market, they exhibit consistent expansion driven by the emergence of new industrial applications.

Competition To Intensify Throughout the Forecast Period

The GaN substrate market is distinguished by a high level of competition among major competitors, who all implement unique approaches to sustain their market standing. The market is dominated in 2023 by notable companies including Cree Inc., Sumitomo Electric Industries, Ltd., Aixtron SE, Kyma Technologies, Inc., Kyocera Corporation, Mitsubishi Chemical Corporation, MTI Corporation, NGK Insulators, Ltd., Shin-Etsu Chemical Co., Ltd., Soitec, Toyoda Gosei Co., Ltd., and Xiamen Powerway Advanced Material Co., Ltd. Strategic initiatives such as product innovation, partnerships, and mergers and acquisitions are the focus of these actors. In an ongoing effort to improve the performance and efficacy of GaN substrates, businesses continue to invest heavily in research and development as product innovation remains a critical business strategy. It is customary to engage in collaborations and partnerships with end-users, research institutions, and technology providers to leverage their collective expertise and develop comprehensive solutions. Furthermore, strategic partnerships and acquisitions are implemented to broaden the scope of operations and enhance existing capacities. In general, the competitive environment is characterized by a harmonious coexistence of well-established entities that propel innovation and up-and-coming firms that pursue specialized prospects.

Media Contact

Company Name: Acute Market Reports, Inc.

Contact Person: Chris Paul

Email: Send Email

Phone: US/Canada: +1-855-455-8662, India: +91 7755981103

Address:90 Church St, FL 1 #3514, New York, NY 10008, USA

City: New York

State: New York

Country: United States

Website: www.acutemarketreports.com